ACCC fine to RedBalloon

I’m busy finding customers and being relentless. My poor family and friends wonder when I will stop asking for leads, opportunities and ideas on how I can grow my businesses. This relentless approach has worked for me, and whilst it might be exhausting for those around me — my single-minded pursuit to fulfill on my vision drives me every day.

Entrepreneurs are salespeople. As business owners we always push, push, push… looking for the next thing. By nature, we see the north star and work tirelessly to get there. As we do this we begin to get some success, this keeps us going.

I was asked recently why I keep working so fervently… as hard as I ever have. Simply put, I am not finished yet. There are more customers to serve.

Our BHAG at RedBalloon was always about ‘changing gifting in Australia forever’. What I meant by this is that when someone is choosing a gift – they would consider buying an experience (that, in turn, supports small business owners) rather than buying ‘stuff’.

RedBalloon has two customer groups; we must serve them both. The gift giving purchaser and the experience business partner who delivers the activity. It is a balancing act to acquire and provide exemplary service to both. Both are equally important to our future success.

My intention has always been to provide the best customer experience to both parties. We continually review the ‘friction’ points of what is not working as well as it should.

I had a five year sabbatical (of sorts) from RedBalloon, which gave me a chance to pursue other ventures (like write books and be on Channel Ten’s Shark Tank) and learn new things. But in July 2017, my business partner David Anderson and I established The Big Red Group, which now owns RedBalloon, Wrapped, The Huddle, redii.com and Marketics. As a result, I returned to RedBalloon with renewed vigour and determination to continue what I started in the capacity as ‘founder’.

On returning to RedBalloon I discovered that not everything was running as smoothly as it should, some fundamentals were being missed. Under the new Big Red Group we set about consistently applying systems and process to reinvigorate the brand.

The question we asked each other mostly; “what would it take to shift this into a completely new realm of customer experience? What would be absolutely disruptive?” We engaged Salesforce to help us on this journey — we were investing greatly in the customer experience. Listening carefully for customer pain points and bottlenecks

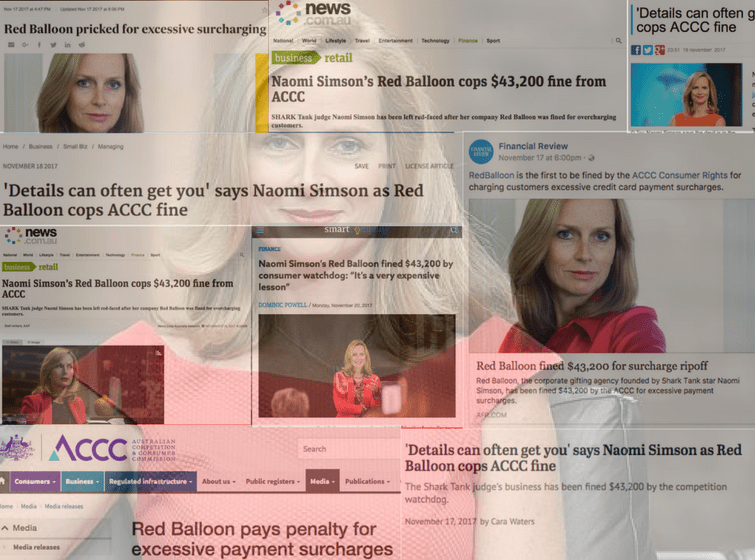

Then bang! Out of the blue a letter arrives from the ACCC alleging that we have not complied with the regulations about passing on the credit card surcharge to customers. The previous management had believed averaging the cost of credit cards i.e. 1.5% was okay (rather than charging the exact amount for each different credit card type i.e. ranging from 0.9%-3.3%).

We were transparent, we fixed the issue immediately. But as I wore the media flack and incurred the penalty, I said “this is never ever going to happen again — what other laws, regulations, governance, and compliance issues are there that I don’t know about?”.

I talk about customer experience, I listen to customer calls. I am curious and interested in the impact we have on people.

Whilst staying up to date on every regulation is difficult (Local, State, Federal), what I attempt to do is subscribe to the newsletters of the ATO, ASIC, ACCC, SmartCompany, ABL, AIM, ADMA AICD, the Retailers Association and many other email subscriptions, which can make my inbox overwhelming.

I need to be more vigilant — that is not enough. So, we have legal advisors, tax advisors, accountants, auditors — all of which are engaged to ensure that we comply, conform and do the right thing and as I said to each of them “Please, please ensure that I am never embarrassed in public again”.

What do I need to do next? I ask myself.

Also published on Medium.

Kelly Robinson says

Tall poppies are easy to see and easy to shoot down. Keep up the great work and inspiration as the business owner that you are.

Caroline Kennedy says

You can’t be on top of everything all of the time. Especially with a diverse portfolio of business ventures. You responded with integrity and rectified the issue immediately. However, the buck stops with the Directors, regardless of ‘previous management’ decisions. No doubt there were lots of lessons, one of which was greater transparency in decision making to ensure compliance. The media flack will subside – there will be a better story tomorrow.

PATRICIA Helen BLUCHER says

Naomi Somson,

You do a wonderful job and you are an inspiration for other woman.

Keep your chin up and just keep doing what you are doing.

David Dahm says

It is more important to ask the right questions than look for the right answers. Most people don’t like the complicated truth until it hurts. The devil is always in the detail once we look past the glossy packaging. Always hard to win trust back.

Chris Forbes says

What do you need to do next? Its impossible for one person to be so vigilant that they can ensure compliance with every law or business code. What you can do is ensure your internal systems are : 1. Compliant with whatever policies your Accountants/Lawyers tell you need to have in place. 2. Easily followed by staff so that non-compliance is a conscious decision, not something that can happen by accident. Its not sexy, it doesn’t generate more business, but it can sure reduce the chance of embarassment

Greg says

Easy fix, don’t charge customers this credit card surcharge fee at all, even Amex we offer and we don’t charge any credit card surcharge fee here as well. This has resolved all problems here and increased sales with Amex, while dropping the fees that Amex normally charge

Colin Green says

You simply can’t cover all of the bases. There are simply too many bases to cover especially in an area as diverse as yours. I guess just close the gaps, pay the money and shrug with a smile. Having learned that lesson does not promise you’ll not get hit by something else just as diverse. Personally I admire you and love your smile. Keep that smile!

Rosalba says

That’s why I have developed a product to help businesses manage their risk against legislation without paying an arm and leg to legal and high priced consultants. Management don’t ever have to fall into this trap again.

Greg Evans says

As a small business owner and experience provider for Red Balloon customers for 12 years, I know Naomi and her team have ALWAYS acted with integrity. You have to wear lots of hats and things fall through the crack from time to time. Having the courage to admit that something’s gone amiss, fixing it and not blaming others or the system … then getting on with business is all you can do. Naomi, this will soon be a speed bump you didn’t see in your rear vision mirror before long. Keep driving ahead with confidence. Australia needs more entrepreneurs to be inspired by business success stories like Red Balloon!

Tony Zhang says

“We were transparent, we fixed the issue immediately. ”

I totally understand of your current situation. A small mistake could ruin your whole kingdom.

Julie says

You can’t know everything Naomi, only when mistakes occur we learn and sometimes it’s an expensive lesson. It’s a good thing we make mistakes, fix them and move forward.

Phillip says

What you need to do is vote in such a way that the ridiculous and overbearing and continuous legislations are reduced so that we can get on with business – Most of us do the right thing, the fact that some do not should be the focus of legislation, not a blanket approach.

Well Done Naomi

Deanne Tindale says

You don’t have to check the red balloons (whatever they may be) are red balloons, you and your Board have to make sure that the policies are in place to ensure the red balloons are checked.

Michelle says

Really, you only got done for that. It is a small error out of all the transactions you process, the deals you make, and the rules you are meant to follow. Don’t be embarrassed, as you said, you learned from it and you won’t let it happen again. You can’t possibly be across everything, but rest assured that your raving fans still think you are amazing and know it was a mistake not an intention.

Cheers

Michelle

Maria says

Naomi I would have thought RedBalloon has 3 clients not 2: the gift producer, the gift giver and the gift user.

I have been in the 3rd category and my feedback is that this area could benefit from some attention.

RedBalloonis a great concept. UX is prohibitive in my view (or it was about 18 months ago).

Catherine says

We are all human and therefore entitled to make mistakes every now and then. It happens. Wear it, own it and learn from it…clearly what you have shown to have done xx

John Frykberg says

Yes, I was surprised to hear about the fine. However you appear to have copped it with grace and clarified how the unintentional error has been corrected and future safeguards implemented.

It’s refreshing to see a suscint admission and reassurance that the newspaper-implied intentional customer rip-off was wrong. Excellent example of frank dealing directly with the issue – an admirable Leader! Best wishes…

Chris sutton says

This is totally unfair. Surcharges like this amount to a tax levied by the eftpos merchant. It’s really pretty simple of you will be charged a surcharge for you wish to continue. Totally unfair totally not in line with the reality of operating a business

Jaime Ponce says

Once again you are giving a wonderful example of how to do things. Your reaction and response to the situation of the ACCC reveals your integrity, honesty and desire to do things right. And that spirit is reflected in a thorough way in RedBalloon.

You are a great woman, but above all a wonderful leader and therefore an example to follow. It’s always inspiring to know about you and what you’re doing.

Thanks for share your experience and thoughts

Kheng says

I think you need to forgive yourself , everyone make mistake . ?

Jason Pace says

Business in Australia is constantly being buried in non sense. You need a whole department to keep up with new laws and changes to legislation. When are governments going to realise that changing laws constantly costs business money. Government needs to get out of the way and focus their efforts in improving their own issues. Once government sort out Energy supply, education, health, transport and planning and development laws, maybe then they can start to look at the private sector. How does the saying go…. people in glass houses should throw stones.

Dale Fraser says

Could have turned this into a positive for your customers and removed credit card fees totally. In this day and age the volume of online transactions that require a card is significant and as such you could build what ever % you liked into your price.

Tracey says

The question of passing on credit surcharges as a business has been around for ever even as a consumer I am asked when using my AMEX card am I aware that there will be a higher charge (same as the old Diners card) I don’t understand irrespective of who made the decision that any business would average a charge across the board. When you were there years ago what model of charging did you use?? Did they only change it to an average when you left? I really do not see this as a tall poppy syndrome as you are both a consumer of goods (aware of how businesses charge you) and a business owner who must be aware of how your business charges it’s customers. Getting caught out has nothing to do with your profile, I see you as no different to anyone else who runs a business especially as you have listed all the areas of compliance we all have to adhere to this one is such a no brainer.

Maria Pickles says

I would not consider this oversight breaking news, the Commonwealth Bank is hard to compete with at present, and I wish more organisations were as transparent as yours, I am sure there are thousands who are over charging on Credit Card Fees.

Brenda Beattie says

What do you need to do next? Relax. You cannot forsee everything that comes your way – however your integrity in rectifying with the ACCC isssue and then sharing the experience has not only been a lessons learned and shared, but a reminder to others to also be vigilant. Love your work Naomi

Yena says

Funding an adequate compliance team and culture within the business to manage compliance is what is needed to make complying with the law in your business something which is known, systemic and “the way we do things around here”. Without an integrated governance program/system, ad hoc solutions can be like putting a bandaid over a bullet wound…. Full disclosure: I am a compliance manager and quite passionate about making sure companies have the right tools to do the right thing- I would recomend checking out the Australian GRC institute. And I do understand that compliance burden is unfairly high on small business, especially those which grow quickly, because in the beginning you’re too small to fund compliance and are at low risk of being a regulatory target; but when you balloon in size there is no one to tell you that your compliance risk profile has changed and that you need to get compliance support and systems! Love RedBalloon and hope to see you in the news only with great news going forward. Best of luck on your compliance journey!

Jenni says

Naomi I’m so glad you posted this article – I thought absorbing the cost in the product was enough – who wants to tell the customer there’s a cost on top of a cost?

Just goes to show I still have so much to learn, so thank you x

David says

Hi Naomi, I run a small business as well as work as a compliance consultant / adviser to small and large businesses. I completely agree with the balancing act of growing a business and ‘keeping out of trouble’ by knowing the laws and regulations.

Practically, without overenginnering it, I think a business of your size needs a regulatory change process to keep abreast of changing requirements. Privacy, data security, fraud are also all very important to ensure you maintain that exemplary customer experience! It’s the only way to stay ahead!

Laura Laura says

Have a risk based Crisis Management framework in place so when there is disruption to your business, from whatever avenue, is managed with support and the response is aligned to your strategic direction and not responded to with chaos that only heightens the sense of embarrassment .

Tracey says

I think a lot of us are losing the plot on this issue!!

Naomi posted HER perspective and justification!

She didn’t need to do that.

She obviously chose to do that as she may have thought that her ‘brand,’ may be affected.

She is not from my perspective a tall poppy, she happens to be on. syndicated TV show, Shark Tank.

If you rewind the tapes of every show she appears on in Australia she will say…..”I’m out!!!!!!” Because you don’t know the FIGURES$$$$

Not because you don’t have a great product, concept just do the sums…..Good Luck with a happy smile.

It could therefore interpretated that she as an

alleged, extremely aware, successful business person is on top of the figures!!!

I can’t buy into the fact that someone in her absence/sabitical/furthering her own personal journey did not leave a section in the policy and procedures manual (she created the manual) that locked in stone according to laws of this country, this is how we charge for interest rates at Red balloon ?

Where is the manual under her watch? What did it say?

Who was at the meeting hosted by the CFO that made amendment to the original policy.

Does this mean I won’t buy from Red Baloon!! I never knew who she was in the first place and I am not an unaware person.

I am a Manufacturer & Wholesaler of a number selling product in Australia, scaling to go globally. Because markets have asked for my product not because I am driven to go.

I watched a couple of episodes of Shark Tank and firmed the measured view that it’s written for Television no more no less.

I have pitched elevator proposals to VC’s that is a totally different concept to what she and her colleagues do.

Please do not go into a pity party if I wasn’t there didn’t know. There is a company policy that exists with or without you and CEO ‘s globally fall on their sword because they should know.

Joe says

Hi Naomi

Love your work! It is interesting to note that the theme of the day is customer experience and customer focus. We sometimes lose sight of the other elements to a good outcome. Such as can my current infrastructure and security investment handle the outcome or is there more to do? As a stakeholder and a commitment to my stakeholders does the outcome make financial and social sense? And of course there is a real broad base of compliance everyone needs to address. I have found the best way of doing this is to rely on each area to be their own experts in as much as possible. For example I would expect that my CFO team and controller are across accounting standards, principles and audit and financial transaction management. My HR team to manage OHS and the like. And then there are regulatory requirements requiring oversight from legal and operations. But the gap is sometimes quite simple. When creating a payment process and associated gateways and credit card relationships no one included the expert. It may be that GST, and Tax as well as Fee regulations were not reviewed, after all it is just processing a payment! Collaborative cross discipline teams should be across your organisations operating capabilities to ensure they are operating efficiently and effectively.

As for any fines and public embarrassment unless you meant to act in an unprofessional or illegal manner it is not worth more than a simple apology, payment and nothing further said. If it weren’t for your work on shark tank this would be a none issue. And you are a great role model.

Mik says

Companies shouldn’t be charging credit card fees these days, I run a small business and our credit card charge is 0.7 percent, how come a big company like that can’t get a better rate than us.

Shyam says

The ACCC should force all bAnks to charge the same surcharge. After all, the costs to them can’t be that different.